AI in BFSI is the next major change in the finance industry in the coming future!

Specifically AI powered chatbots in Finance industry is evolving at a very fast pace. As per the reports, chatbots in BFSI market size was valued at USD 890 million in 2022, and its predicted to reach 6170 million by 2030. The consumer behavior in finance industry is changing where these AI powered financial AI chatbots are assisting users to perform various finance tasks and executing them with utmost accuracy.

Major players in this domain are implementing finance chatbots to resolve the user queries with instantaneous responses, increasing the CSAT score.

In this blog, we will discover how AI, specifically chatbots are revolutinizing the finance sector.

What are Finance Chatbots?

Finance chatbots are AI-powered virtual assistants designed to help users manage their financial activities. They provide a range of services, from answering banking queries and offering budgeting advice to executing transactions and monitoring spending patterns. Natural Language Processing and Machine Learning, are the key driving factors of these AI finance chatbots, designed to deliver personalized, real-time support, enhancing customer experience and operational efficiency for financial institutions.

Why Chatbots Should Serve as Personal Finance Assistants

Chatbots are ideal personal finance assistants due to their efficiency and convenience. They provide instant access to financial information, track expenses, set budget goals, and offer personalized financial advice.

By utilizing AI and machine learning, chatbots learn user preferences, making their assistance increasingly tailored over time. Their instantaneous availability ensures continuous support, helping users make informed financial decisions anytime.

This combination of real-time assistance and personalized service makes chatbots invaluable for managing personal finances.

How Finance Chatbots Work

Finance chatbots operate through advanced AI technologies, including natural language processing (NLP) and machine learning. When a user interacts with a chatbot, NLP allows the bot to understand and interpret the user’s queries.

The chatbot then uses predefined algorithms and data analysis to generate appropriate responses or actions. Machine learning enables the chatbot to learn from user interactions, continuously improving its accuracy and personalization.

These bots can access financial databases, perform transactions, provide spending insights, and offer tailored financial advice, all in real-time. This seamless interaction enhances user experience by making financial management more accessible and efficient.

Integrating Chatbots for Seamless User Experience

Integrating chatbots across online platforms is not merely a customer service enhancement; it is a strategic move that transforms these bots into personal financial assistants for customers, thereby enhancing their overall experience and satisfaction. Whether it’s on a website, social media platform, or a customer relationship management (CRM) system, the seamless integration of chatbots provides a unified and efficient channel for users to manage their finances.

The key advantage lies in the immediacy and accessibility that chatbots offer. By integrating these virtual assistants into your company’s digital infrastructure, customers can effortlessly inquire about account details, track transactions, and receive financial advice in real-time. This not only streamlines the user experience but also builds trust and loyalty by showcasing a commitment to providing comprehensive support beyond traditional services.

Benefits of Financial AI Chatbots

Integrating chatbots with your B2B company’s financial digital platforms brings forth a multitude of benefits, enhancing customer engagement, loyalty, and accuracy. The following highlights the advantages:

- 24/7 Availability: Chatbots provide round-the-clock support, ensuring users can access financial assistance anytime, anywhere.

- Instant Responses: They deliver real-time answers to queries, enhancing user satisfaction and reducing wait times.

- Cost Efficiency: By automating routine tasks, chatbots reduce the operational costs for financial institutions.

- Personalized Advice: Leveraging AI, chatbots offer tailored financial advice based on individual user behavior and preferences.

- Enhanced Security: Advanced encryption and authentication measures ensure secure transactions and data protection.

- Improved Financial Management: Users can track expenses, set budgets, and receive reminders, promoting better financial habits.

- Scalability: Chatbots can handle multiple queries simultaneously, making them scalable solutions for growing customer bases.

8 Examples of Financial Chatbots

There are a list of major players who have implemented these AI powered Financial Chatbots in their digital platforms. Looking at the benefits and the accuracy these chatbots provide, they can be a successful assistants for their business.

Let’s look at the examples of these financial chatbots:

1. Erica by Bank of America: Erica helps users manage their finances by providing insights on spending, tracking bills, and offering personalized savings tips.

2. Eva by HDFC Bank: Eva can answer banking queries, provide account information, and guide users through various banking services.

3. MyKai by Kasisto: MyKai allows users to track their finances, make transactions, and receive financial insights via messaging apps like Facebook Messenger and WhatsApp.

/cdn.vox-cdn.com/uploads/chorus_asset/file/6716239/mykai.0.jpeg)

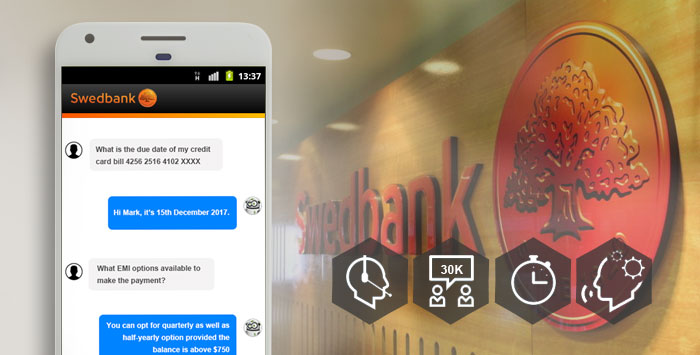

4. Nina by Swedbank: Nina assists users with banking queries, helping them navigate through services and offering personalized financial advice.

5. SEB: SEB Finance chatbot handles customer inquiries, assists with transactions, and provides financial guidance through natural language conversations.

6. Emirates NBD: This chatbot helps users manage their accounts, transfer funds, and provides financial recommendations.

7. Ceba by Commonwealth Bank: Ceba assists with everyday banking tasks, such as checking account balances and transferring money, while offering spending insights.

8. Amy by HSBC: Amy can answer questions about banking services, help with transactions, and provide financial tips to users.

Chat360 Transforming B2B Finance with Rule-Based Chatbots

Chat360 stands out as a leading provider of chatbot solutions tailored for businesses. Chat360’s AI powered Financial Chatbotsseamlessly integrate with various online platforms, including WhatsApp, Instagram, Facebook, websites, and CRM systems. These chatbots go beyond generic responses, finely tuned to understand and address specific financial queries. Whether providing account balances, explaining transaction details, or offering investment recommendations.

Chat360’s chatbots excel in delivering accurate and relevant information. The integration with CRM platforms ensures a holistic approach, with users receiving consistent support across all touchpoints.

Furthermore, the user-friendly interfaces of Chat360’s chatbots enhance the overall user experience. The conversational nature of interactions creates a more engaging and intuitive platform for users to navigate their financial landscape, reflecting positively on your company’s commitment to providing top-notch customer service.

The integration of chatbots as personal finance assistants in B2B companies is a strategic move that goes beyond efficiency gains. The benefits of rule-based chatbots, particularly those offered by Chat360, encompass accuracy, consistency, and enhanced user satisfaction, ultimately elevating the financial well-being of users in the digital age.

Schedule a free demo today!